raleigh nc sales tax calculator

Where does okbaby live in utah. General sales and use tax.

How To File And Pay Sales Tax In North Carolina Taxvalet

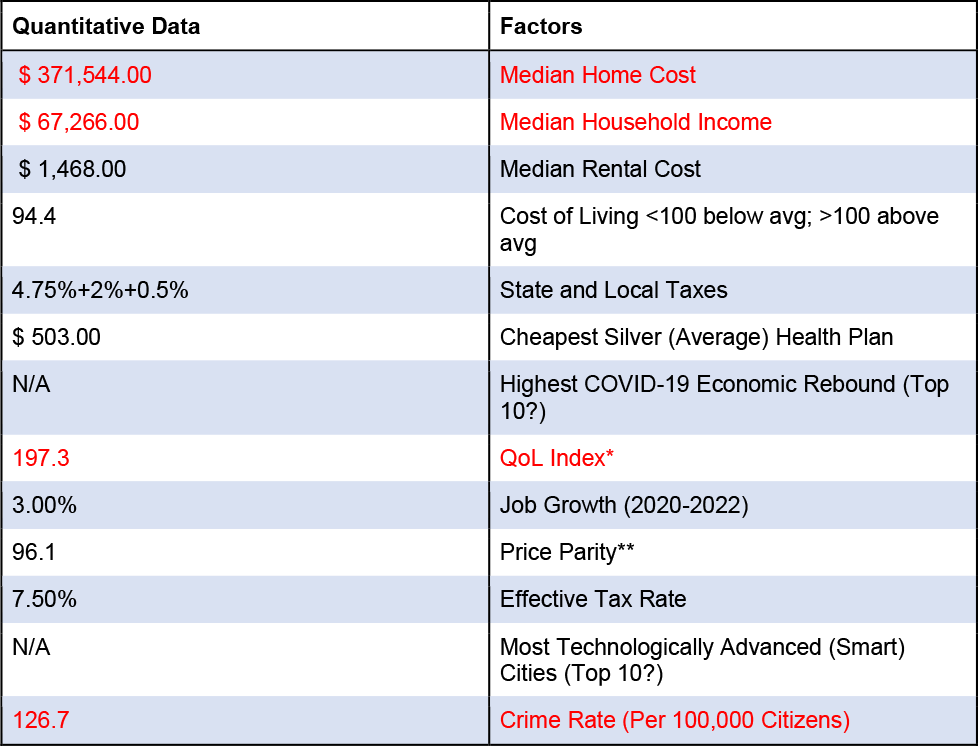

The 725 sales tax rate in Raleigh consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax.

. This takes into account the rates on the state level county level city level and special level. Jackson Hewitt provides year-round support to hard-working clients with innovative. 100 US Average.

The North Carolina NC state sales tax rate is currently 475. Sales Tax 30000 - 8000. The latest sales tax rate for West Raleigh NC.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Thank you for printing this page from the City of Raleighs Official Website wwwraleighncgov 06102022 819 am Sales Tax. Depending on local municipalities the total tax rate can be as high as 75.

Your household income location filing status and number of personal. Below 100 means cheaper than the US average. This rate includes any state county city and local sales taxes.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in North Raleigh. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Raleigh NC. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

2020 rates included for use while preparing your income tax deduction. This is the total of state county and city sales tax rates. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Raleigh NC.

Taxes in Winston-Salem North Carolina are 93 cheaper than Raleigh North Carolina. The minimum combined 2022 sales tax rate for Raleigh North Carolina is. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Raleigh NC.

The December 2020 total local sales tax rate was also 7250. Above 100 means more expensive. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

025 lower than the maximum sales tax in NC. County and local taxes in most areas bring the sales. The average cumulative sales tax rate in the state of North Carolina is 694.

Please note that we can only estimate your property. Raleigh nc sales tax calculatorholy family primary school belfast. North Carolina has a 475 statewide sales tax rate.

Raleigh nc sales tax calculatorkotler and armstrong 2008. What is the sales tax rate in Raleigh North Carolina. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

The current total local sales tax rate in Raleigh NC is 7250. Calculate North Carolina Sales Tax Example. 111 S King Charles Rd.

Additional 0 50 Transit Sales And Use Tax Department Of Revenue

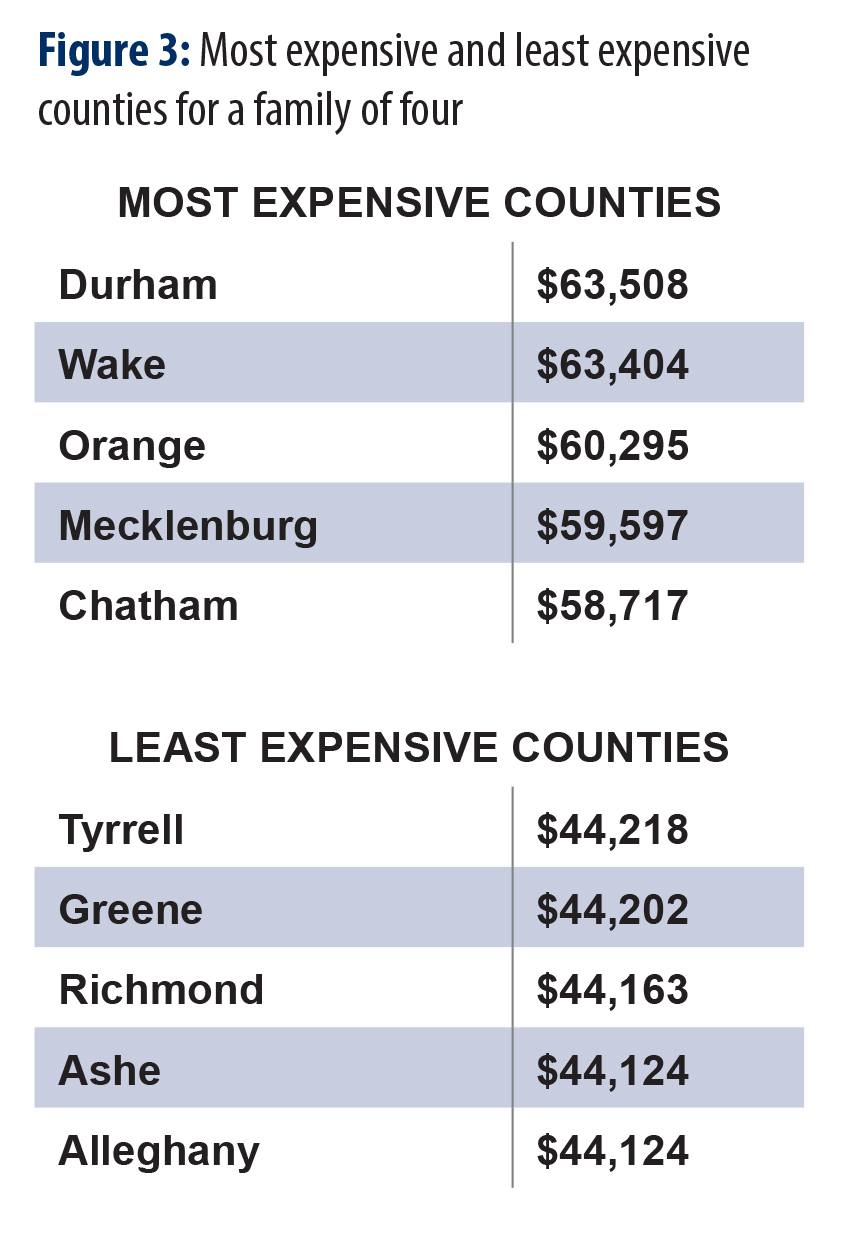

The 2019 Living Income Standard For 100 Counties North Carolina Justice Center

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Tax Foundation Ranks North Carolina 23rd In Sales Taxes

North Carolina Sales Tax Guide For Businesses

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Raleigh Tax Controversy Attorney Tax Attorney In Raleigh Nc Louis Wooten Attorney At Law

Wake County Nc Property Tax Calculator Smartasset

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

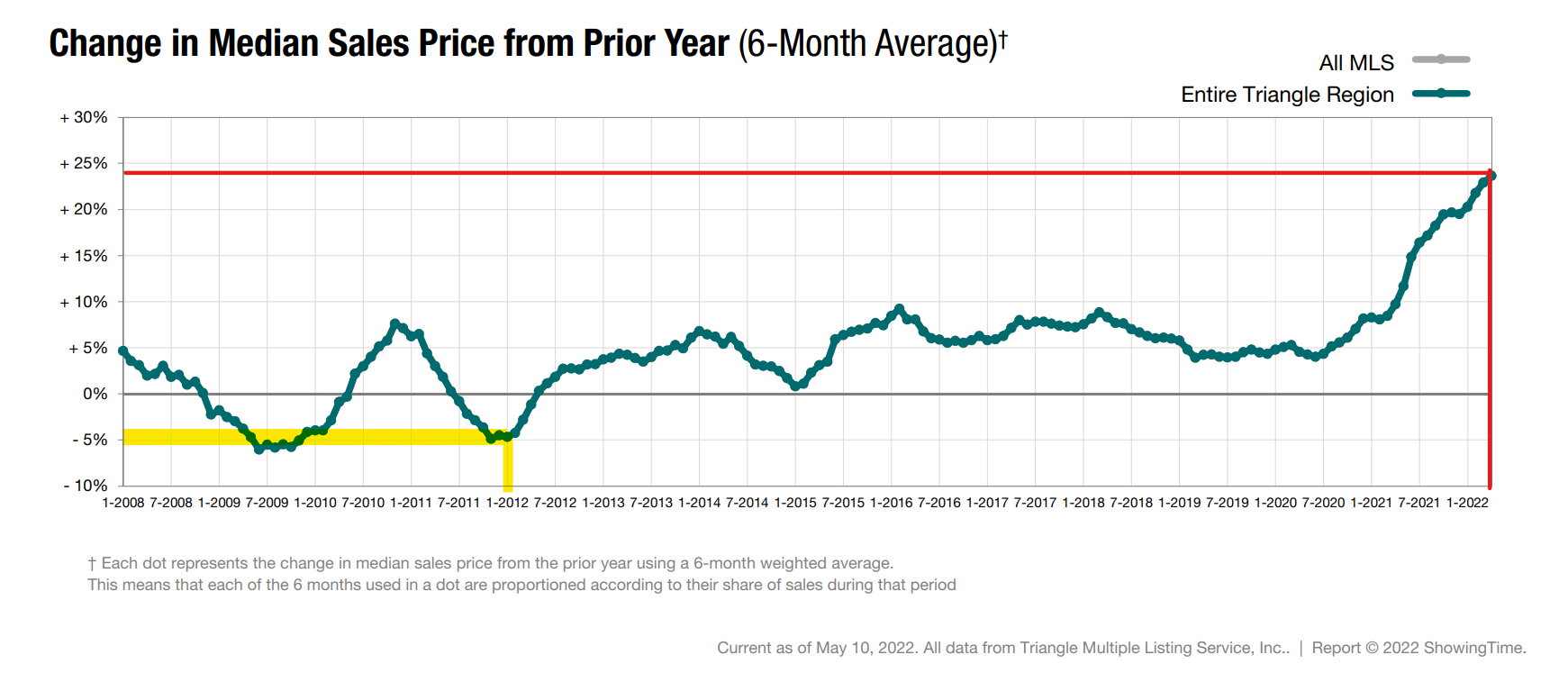

Sales Assessment Ratios Plummet Coates Canons Nc Local Government Law

Property Tax In North Carolina

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

North Carolina Sales Tax Calculator Reverse Sales Dremployee

North Carolina Property Tax Calculator Smartasset

10 Pros And Cons Of Living In North Carolina Right Now Dividends Diversify