virginia electric vehicle tax credit 2022

The full electric vehicle tax credit will be available to individuals reporting adjusted gross incomes of 150000 or less or 300000 for joint filers. The credit is also transferrable.

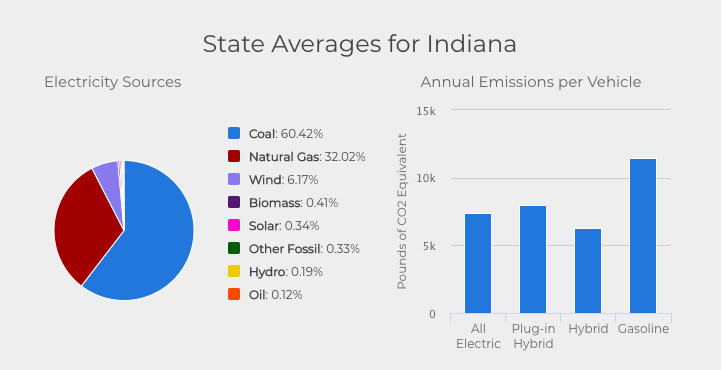

Electric Vehicles Have Lower Well To Wheel Emissions In All 50 States And Dc Than Gas Powered Vehicles Evadoption

Beginning July 1 2022 EV drivers may choose to enroll in a mileage-based fee program in lieu of highway use fee.

. A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000 enhanced rebate. The full phase-out already occurred for GMs Chevrolet Bolt Volt and Cadillac CT6 Plug-in and ELR for example with these EVs becoming ineligible for the credit after the end of March 2020. Tesla TSLA -24 and General Motors GM -25 have both maxed out their credits and Toyota.

By Associated Press Aug. General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018. Manchin said at a.

Check out these National Drive Electric Week Events in Virginia. Read the Virginia Transportation Electrification Stakeholder Report May 26 2022. Reference Virginia Code 101-130704 Electric Vehicle EV Fee.

The PTC provides a corporate tax credit of 12 centskWh for electricity generated from landfill gas LFG open-loop biomass municipal solid waste resources qualified hydroelectric and marine and hydrokinetic 150 kW or larger sources. Information in this list is updated throughout the year and comprehensively reviewed annually after Virginias legislative session ends. Claim the credit against the following taxes administered by Virginia Tax.

Showcasing EV technology with government and private fleets August 4 2022. Automakers want Democratic Senator Joe Manchin to revisit his proposal to restructure the 7500 electric vehicle tax credit raising fears. From July 1 st until the end of the year the credit is only worth 1875.

From 2020 you wont be able to claim tax credits on a Tesla. Review the credits below to see what you may be able to deduct from the tax you owe. A tax credit of up to 7500 could be used to defray the cost of an electric vehicle under the Inflation Reduction Act now moving toward final approval in Congress.

Theres a waiting list for EVs right now with a fuel price at 4 but they still want us to throw 5000 or 7000 or a 12000 credit to buy an electric vehicle Mr. On or after Jan. Virginia electric vehicle tax credit 2022.

The new bill would look to reinstate up to 7000 in tax credits for these EVs. The tax credit would be available only to couples with incomes of 300000 or less or single people with income of 150000 or less. Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500.

Before this date it remains a tax credit. The bill would allow car buyers to continue to claim the current 7500 federal tax credit for the purchase of clean vehicles the new. 2500 towards the purchase or lease of a new or used battery electric or plug-in hybrid electric vehicle.

5000 towards the purchase or lease of a new or used battery electric or plug-in hybrid electric vehicle. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. According to the white house eligible evs will need to be made in the us with union labor to qualify for the full 12500 credit.

500 EV Tax Credit. EV vans trucks and SUVs with an MSRP of up to 80000 qualify increase from before The electric car tax credit is only available to individuals with a gross income of 250000 or less decrease from before. Used EVs must be at least two years old and the used credit can only be claimed once in the life of the vehicle.

In its final form the program which would begin Jan. EV owners must pay an annual highway fee of 11649 in addition to standard vehicle registration fees. All those vehicles are assembled in North America.

Email the Technical Response Service or call 800-254-6735. An enhanced rebate of 2000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines. Getty Images Paul Bersebach.

1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. The maximum credit allowed is 5000 not to exceed your tax liability. Used EVs would now be eligible for a 4000 federal tax credit wit a price cap of 25000.

Electricity from wind closed-loop biomass and geothermal resources receive as much as 23 centskWh. Tax filers can claim only one EV tax credit every three years. Reference Virginia Code 462-770 through 462-773.

Virginia Clean Cities Harrisonburg Alternative Fuel Vehicle Showcase April 13 2022. The tax credit would be available only to couples with incomes of 300000 or less or. From April 2019 qualifying vehicles are only worth 3750 in tax credits.

If at least 50 of the battery components in your EV are made in the US. The current tax credit of up to 7500 phases out after automakers produce 200000 electric vehicles. Electric vehicle federal tax credit up to 7500 a federal income tax credit up to 7500 is available for the purchase of a qualifying ev.

Some other notable changes include. Carry forward any unused credits for 3 years. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page.

Harvey Eugene Mcalexander Discovered In Virginia Marriage Records 1936 2014 Marriage Records Marriage Health Statistics

1998 Honda Civic 1998 Honda Civic Dx Hatchback 2022 2023 Is In Stock And For Sale Price Expert Review 2022 2023

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Rebates And Tax Credits For Electric Vehicle Charging Stations

Tesla To Open Service Center In Virginia Beach Transport Topics

Clean Energy Tax Package Undergoes Substantial Shifts Roll Call

Are Michigan S Registration Fees On Electric Vehicles Causing It To Fall Behind Other States

90 Of Americans Don T Have Easy Access To Public Ev Chargers

Pay Online Chesterfield County Va

Ev Tax Credit Expansion Automakers Ask Congress To Revive Effort

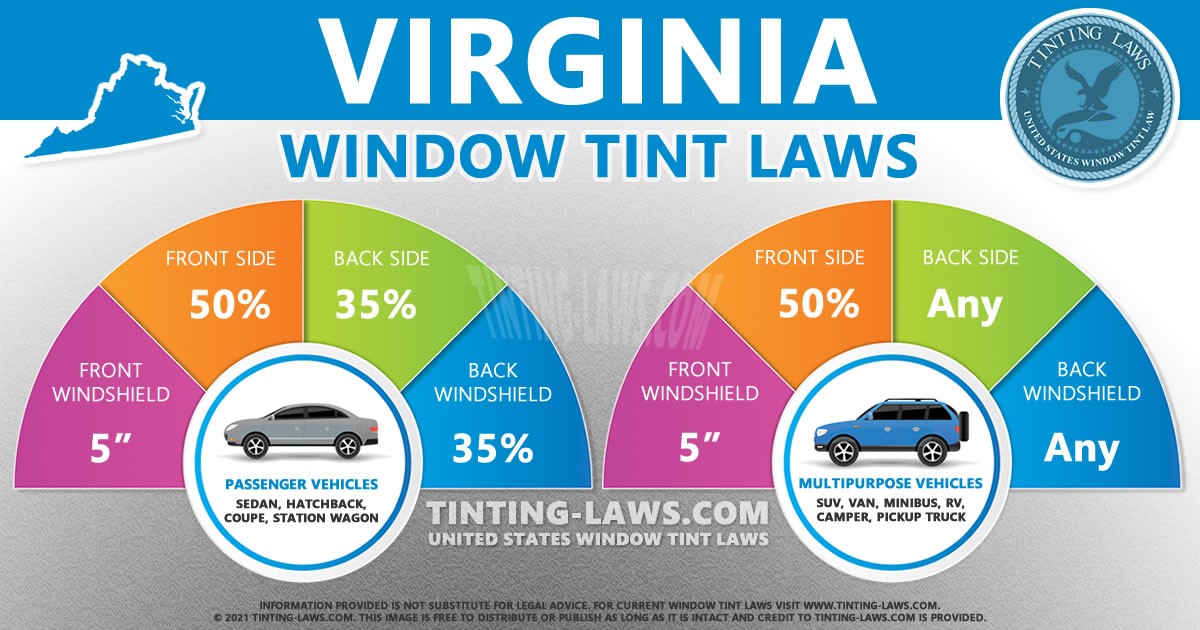

Virginia Tint Laws 2022 Updated Car Tinting Laws

/cloudfront-us-east-1.images.arcpublishing.com/gray/5BRBUNT5HJEV3FAU4MARGFN4PY.jpg)

New Law Means Lower Vehicle Registration Fees In Virginia But Added Highway Use Fee

Virginia Sales Tax On Cars Everything You Need To Know

Electric Vehicles Are Cheaper Than Gas Powered Depending On The State And Incentives Pv Magazine Usa

High Gas Prices Have A Lot More People Searching For Electric Vehicles Grist